Two Sides of a Coin

Single-family homes as well as multifamily homes are proven real estate investment vehicles. While both types of rentals have great track records in terms of income generation, they vary on multiple accounts. Most often, there is no right or wrong, but just what’s apt for your particular circumstances as an investor. The kind of rental property you choose will reflect what stage your career is at; how deep your pocket is; and what long-term real estate strategy you plan on using.

Having said that, it’s important, especially for novice investors to understand the pros and cons of both these rental types. Understanding what sets them apart can go a long way in not just deciding what’s best for you now but probably even the direction of your entire investment career.

Advantages of Single Family Properties

1. Greater Inventory and Affordable

2. Better Appreciation

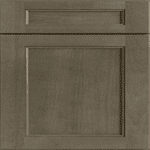

It’s a proven fact that appreciation is better when it comes to single family homes. Especially, if they are located in a neighborhood that has great features, like a great school district, access to amenities like shopping, restaurants and entertainment, the prices are bound to go up over time. Additionally, if sensible upgrades in line with current design and market trends are made to the property, then you stand to gain much more. Even without any upgrades, a gently used single family home is much likely to appreciate when the market is stable.

3. Lesser Turnover

When it comes to single family homes, the kind of people that rent them are mostly families with children or couples looking to settle down and start families. These people are looking for stability in their lives, which begins at home. They are not the kind who are likely to up and move within a year or sooner. Instead, they are people who are probably interested in experiencing living in a house, but don’t yet want the responsibility of a mortgage or big ticket maintenance. All these factors make for lesser turnover, which means lesser worries for you, the landlord.

4. More Ways to Exit

When it comes time to sell, single family homes are some of the easiest properties to sell because there are many types of buyers interested in such properties. They appeal to

• people looking to buy their first home

• people hit by financial hardship and forced to downsize

• growing families looking for bigger homes

• other investors

• home flippers

With such a large pool of interested buyers, investors often breeze through the resale of their single family homes, as long as they’re well maintained and meet the expectations of target buyers.

5. Better Locations

6. Easier to Manage

Many investors believe that it’s far easier to manage single family homes because, as landlords, they aren’t responsible for the utilities. Also, when it comes to families living in such properties, they generally treat it as their own home which translates to gentle use. On the same lines, such tenants also tend to fix small issues by themselves which requires the landlord to step in only when there are capital expenses.

Disadvantages of Single Family Properties

1. Expensive to Manage Professionally

2. Not as Scalable as Multifamily Homes

While single family homes are a great way to begin your investment career, they aren’t always the best way to scale your business. You can definitely build up an impressive investment portfolio, buying one or two houses every couple of years. However, you won’t be making as much money as you would from a single multifamily property.

3. Price Set by Comparable Homes

When it comes to the sale of a single family home, the price is always dictated by the market and comparable homes. The value of such properties depends on the demand and supply of buyers who plan on occupying the home themselves.

Advantages of Multifamily Properties

1. Efficient as Investment Vehicles

2. Scalable

It’s quite obvious that the scalability of the multifamily property is at the core of its allure. Nothing can compare to the rate at which a successful multifamily rental can increase your monthly income. In one shot, you will skip all the legwork required to buy and rent out several single family homes and yet, you will be making much more in terms of profit.

3. Lower Vacancy Expenses

When it comes to real estate investing, the vacancy rate of your property is an important consideration. The longer it lies vacant, the more it eats out of your pocket in terms of utilities and maintenance. This is especially true when it comes to single family homes. On the other hand, multifamily properties are sort of insulated against the effects of vacancy – the income streams from all your other occupied units will usually compensate for the ones that are lying vacant.

4. Better Returns

5. Inexpensive to Professionally Manage

When it comes to multifamily properties, that have more than four residential units, the ideal thing to do is to hire a property management company to manage the day-to-day affairs of the property. This is not just an efficient way to manage your rental properties, it is also a cost-effective way because such firms charge lesser (compared to single family homes) to manage multifamily properties. Overtime, the professional management of your rental properties will not just become more profitable, but will also free up your time, allowing you to focus on your business.

6. Lower Price Per Unit

Though multifamily properties cost more upfront, and need the investor to be financially sound, they are actually cheaper when you break down the numbers. Compared to an investor acquiring single family homes, you will be spending considerably lesser on every unit that’s within your property.

Disadvantages of Multifamily Properties

1. More Investment Upfront

2. Damaged by Tenants More Often

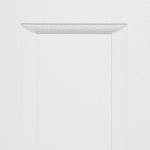

Besides being fickle as tenants, young and single people also tend to be harsh on the property. They know they aren’t going to live their entire lives in your apartment, which makes them not really care for the space sometimes. Some of the major damages are borne by the carpet, walls, countertops and bathrooms of apartments.

3. Landlord Responsible for Utilities and Upkeep

Unlike single family homes, where the landlord can happily forget about paying for utilities, landlords of multifamily properties are responsible for things like water and sometimes even electricity and gas. Besides these, the landlord needs to make sure the curb appeal of the property is in good shape as well.

The Bottom Line

More often than not, multifamily properties are seen by investors as the next step in their careers. It’s always safer to start with single family homes when you’re new to investment. However, it’s not impossible for a new investor to win with a multifamily property – it will just be much harder and will require greater financial soundness. Whatever be the investment property you choose, it needs to conform to your long-term goals and aspirations as a real estate investor.